At deas Real Estate Solutions, we define ourselves as your holistic advisor along the entire value chain of your assets.

But what exactly does that mean?

We support our clients from the initial planning phase of their property till purchase or sale - with comprehensive advice and protection.

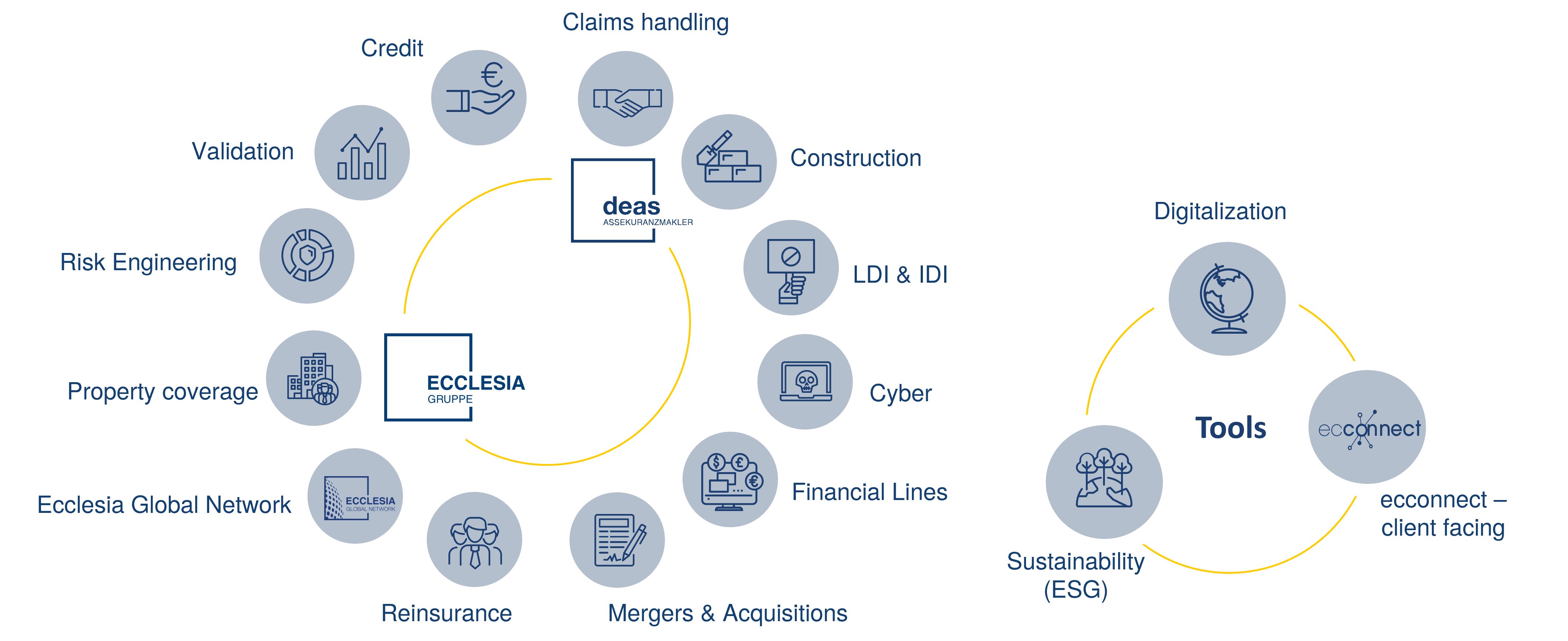

Our holistic approach offers 360° consulting, which is professionally supported by our in-house experts from relevant specialist areas such as Construction, M&A or Financial Lines.

Latent defect insurance - protection against hidden construction defects

Building is an investment in the future - but even with the greatest care, hidden construction defects can occur that only become visible years after completion. This is exactly where Latent Defect Insurance (LDI), also known as building warranty insurance, comes in.

This special insurance covers you against structural damage caused by hidden construction defects. Whether cracks in load-bearing walls, faulty foundations or leaking roofs - LDI covers the costs of remedying defects without the need to determine who is at fault.

Your advantages at a glance

- Financial security without lengthy legal disputes

- Protection for new buildings, commercial properties and renovation projects

- Long-term protection - often up to 10 years after completion

- Increased property values and increased confidence among buyers and investors

Whether you are a property developer or investor - with latent defect insurance you minimise risks and protect your property in the long term.

Hedging of real estate backed non-performing loans (NPL)

Non-performing loans (NPLs) that are collateralised by real estate represent a considerable risk for banks, investors and lenders. Targeted insurance protects against financial losses and offers security in a volatile market.

With a customised insurance solution for real estate-backed NPLs, you can protect yourself against unexpected payment defaults and losses in value of the deposited properties. This means you remain capable of acting and can manage your portfolio strategically. Both the transaction can be covered by individual W&I insurance and the portfolio itself can be insured as part of a combined all-risk property insurance (from NPL to forced place to REO status - ‘flip policy').

Your advantages at a glance

- Protection against financial losses due to payment defaults

- Protection against impairment of the collateralised properties

- Optimisation of the balance sheet structure and risk minimisation

- More planning security for investors and lenders

Whether banks, private equity fonds or institutional investors - we offer you customised solutions to secure your real estate backed non-performing loans.

The next events

You can find us at the following events:

- Axco Global Insurance Summit | London | April 23rd - 25th 2025

- „polis CONVENTION“ | Düsseldorf | May 7th 2025

- Expo Real, Munich | August 06th - 08th 2025

Contact us

Do you have any questions about our special concepts for the commercial real estate industry?

Get in touch with us!

Thorsten Köcher

Head of Real Estate Solutions

Phone +49 221 67082218

Mobil +49 151 23066451

E-Mail thorsten.koecher@deas.de